Calculate fica 2023

FICA tax includes a 62 Social Security tax and 145 Medicare tax on earnings. Taxable capital gains that should be included in taxable income R 372 500 x 40 R 149 000.

Social Security Changes That May Be Coming For 2023 Gobankingrates

See your tax refund estimate.

. This tax is broken up into 62 for Social Security and 145 for Medicare. So if you wanted to determine your. Social Security and Medicare Withholding Rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

To calculate your businesss FUTA tax liability determine your employees wages subject to FUTA tax. To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145. You can calculate your FICA taxes by multiplying your gross wages by the current Social Security and Medicare tax rates.

Pauls taxable income R. Lets say your wages for 2022 are 135000. Well calculate the difference on what you owe and what youve paid.

The current rate for. The amount that you should withhold from the employee. This projection is based on current laws and.

In 2022 only the first 147000 of earnings are subject to the Social Security tax. Ad Being an Industry Leader is Earned Not Given Business Planning Simplified. For self-employed workers the rate is 124.

The employer and the employee each pay 765. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. If youve already paid more than what you will owe in taxes youll likely receive a refund.

Please note that the self-employment tax is 124 for the Federal Insurance Contributions Act FICA portion and 29 for Medicare. The FICA withholding for the Medicare deduction is 145 while the Social Security withholding is 62. According to the SSA a worker with wages equal to or larger than 147000 would contribute 911400 to the OASDI program in.

Our online Annual tax calculator will automatically work out all your deductions based on your Annual pay. Heres how you would calculate FICA taxes for this employee. Net capital gain R 412 500 R 40 000 annual exclusion R 372 500.

Over a decade of business plan writing experience spanning over 400 industries. The SSA provides three forecasts for the wage base intermediate low and high cost and all predict an increase to 155100 in 2023. What is FICA tax.

If the employee earns 147000 prior to the end of the year the employee no longer pays into FICA theyve capped out their benefit earnings. Since the rates are the same. On the other hand if you make more than 200000 annually you will pay.

Start with their gross pay -- their total salary or wages before deductions. The current FICA tax rate is 765 of your employees incomes plus an employer match of 765. Social security taxes 823980 this is calculated by multiplying.

However if the employee earns in. The OASDI tax rate for wages paid in. Calculate FICA tax.

As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. The FICA portion funds Social Security which provides. This means together the.

FICA tax is shared evenly between you and your employee you both pay the same percentage of employee wages. Start the TAXstimator Then select your IRS Tax Return Filing Status. For 2023 the trustees estimate that the taxable wage base will be 155100 up 8100 from the current wage base of 147000.

The tax calculator provides a full step by step breakdown and analysis of each.

2023 Social Security Cola Could See Significant Increase Alongside Inflation Benefitspro

The Inflation Reduction Act Won T Affect Most Americans Tax Bill

4 Social Security Changes To Expect In 2023 The Motley Fool

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

When Is Social Security Increase For 2023 Announced Cola May Be Most In 40 Years Oregonlive Com

Spanish Calendar 2023 2024 Years Week Starts On Monday Vector Stock Vector In 2022 Embroidery Patterns Free Templates Vector Illustration Embroidery Patterns Free

Social Security Could Get A 7 6 Raise In 2023 But It S Not All Good News The Motley Fool

Social Security Ending In 2023 No But What Really Happens When The Trust Fund Is Emptied

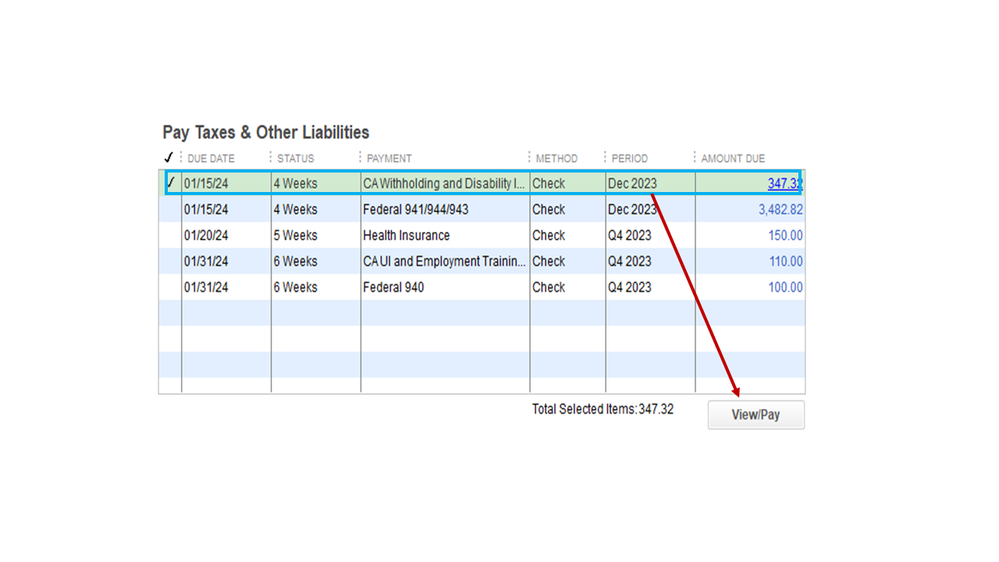

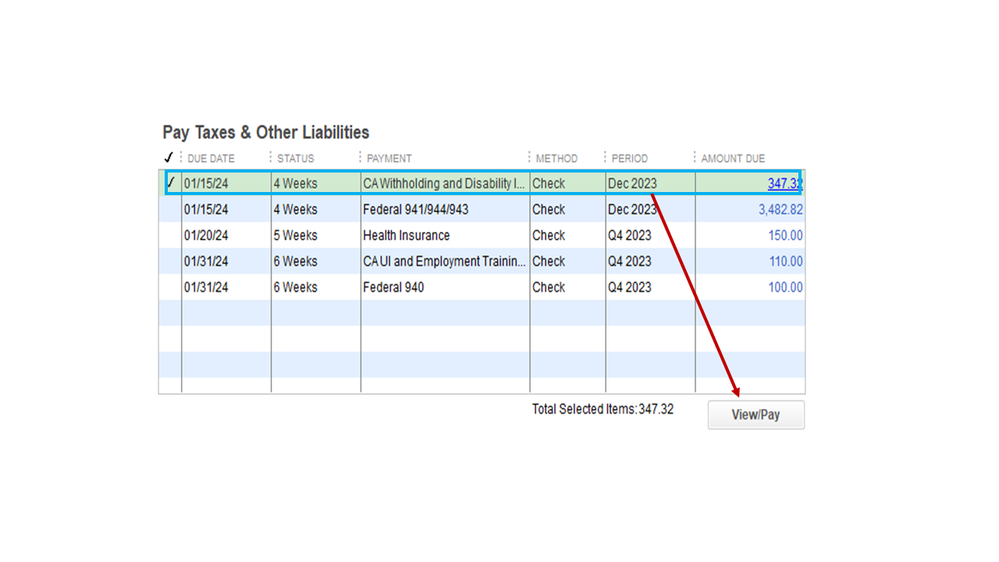

How Do I Update New Eftps Password In Qb 2020 But Qb Instructions Aren T Matching My Qb Screen My Rejected Payroll Is Onlyvisible In The Pymt History In The E Pymts Tab

Social Security What Is The Wage Base For 2023 Gobankingrates

1uuatajsq55tvm

2 Social Security Changes That Could Benefit You In 2023 And 1 That Might Cost You The Motley Fool

Social Security Benefits Could See Higher Than Expected Increase In 2023 Fox Business

Which Teams Are In The 2022 23 Uefa Champions League Confirmed Clubs Group Stage Field Tournament Rules And Format Sporting News

Who S Ready For 6 Big Changes To Social Security In 2023 The Motley Fool

Social Security Benefits Could Increase By More Than 1 800 In 2023 Cnet

Social Security Benefits Could Be Permanently Depleted By 2023 If Payroll Taxes End